TAX RATES Each class of beneficiary has its own separate tax rate. Looking to expand your knowledge on a particular subject matter.

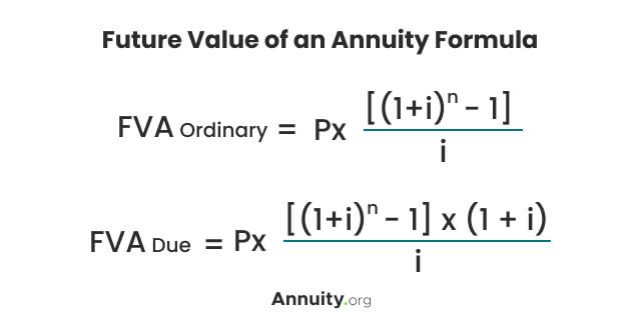

Annuity Formula Calculation Examples With Excel Template

Therefore if you are processing a return in one of these states use the State and State use fields and in a few cases the RR tier 2 benefits field on the 1099R screen and the Averaging method field on the 1099R-2 screen in the 1099R screen to identify pensions that.

. There are some states that tax pensions differently from the federal government. Section 403b annuity contracts custodial accounts and retirement income accounts. Form 8915-F replaces Form 8915-E.

Annuity benefits stop at the end of the month before the one in which any of the above terminating events occurs. See the Rate Schedule on Page 4. The last payment annuity for May would be issued on June 1.

Not all annuity providers offer enhanced annuities so you should always shop around as many providers as possible if you think you qualify for one. Wishing for a unique insight into a subject matter for your subsequent individual research. Federal Employees Health Benefits FEHB Program qualifies as minimum essential coverage MEC and meets the Patient Protection and Affordable Care Act.

Reaches age 18 marries or dies. For example if a child turns 18 on June 29 annuity benefits would stop May 31. Find out about the steps you need to take to get the best income in retirement in our guide to buying an annuity.

The regs contain proposed regulations relating to RMDs from qualified plans. That is only true if you buy a lifetime annuity or take payments under the SEPP rule. Annuity benefits terminate when a child.

ALL YOUR PAPER NEEDS COVERED 247. The transfer of real and personal property in this State held by a husband and wifecivil union couple as tenants by the. Please Use Our Service If Youre.

Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022 as applicableIn previous years distributions and repayments would be reported on the applicable Form 8915 for that years. If your annuity starting date was between July 1 1986 and November 19 1996 you were able to elect to use the Simplified Method or the General Rule. After you retire you will still have the opportunity to change your enrollment from one plan to another during an annual open season.

Then simply pick the one that offers the most. You cannot change to another plan simply because you retired. Qualifies for exemption as a Class E beneficiary since the criteria are different.

No matter what kind of academic paper you need it is simple and affordable to place your order with Achiever Essays. The following are qualified plans. You may have heard that income from an annuity qualifies as an exception from the pre-59-12 tax penalty.

Individual retirement accounts. Either way the monthly payment from a life annuity or SEPP withdrawal would be a much smaller dollar amount than how much you would receive by distributing 100k over a 7. By December 31 of the year following the year of death the entire eligible part of the RRIF property is directly transferred to a registered retirement savings plan RRSP PRPP specified pension plan SPP or RRIF under which the spouse or common-law partner is the annuitant or to an issuer to buy an eligible annuity for the spouse or common-law partner.

Where can I buy an enhanced annuity. This choice is irrevocable and applied to all later annuity payments.

Present Value Of An Annuity How To Calculate Examples

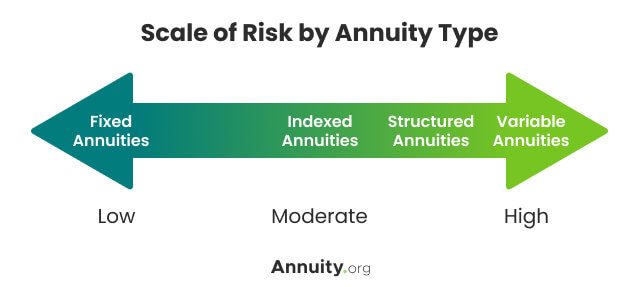

Annuity How Annuities Work Rates Types Pros Cons

0 Comments